How to identify suppliers from company registration documents

In recent years, many buyers have posted stories of fraudulent purchases in China on the social media such as fakebooks and Linkedin. the problems involved in payment done but goods not shipped, the goods received not matching the samples, and the wrong remittances sent to other accounts.

In fact, China has a sound business legal system, especially for foreign trade . Not only require the obtain an industrial and commercial business license, but also need permission from the customs, inspection and quarantine bureau, and business bureau. But these license files are only in Chinese.

In this post, I will tell all buyers who import from China how to identify the supplier’s company registration documents to reduce trade risks.

1.Business license

The business license is the most basic document for all legal business in China and is issued by the Administration for Industry and Commerce to register the basic information of the legal company. Even if the language is not English, you can get the truth from the register No. The No start with 9 was the registration number, and the following is the registration date. It should be noted that the issue date was not equal with the registration date. It only shows the issuance time of the business license and the license can be reissued by goverment according to different version .

Using the registration number on the business license, you can check the company’s more detailed registration information in the national corporate credit information disclosure system and “Tianshicha”, whether there are some bad records.

Remember that, the business license is the most basic document and all the legal supplier should have it .

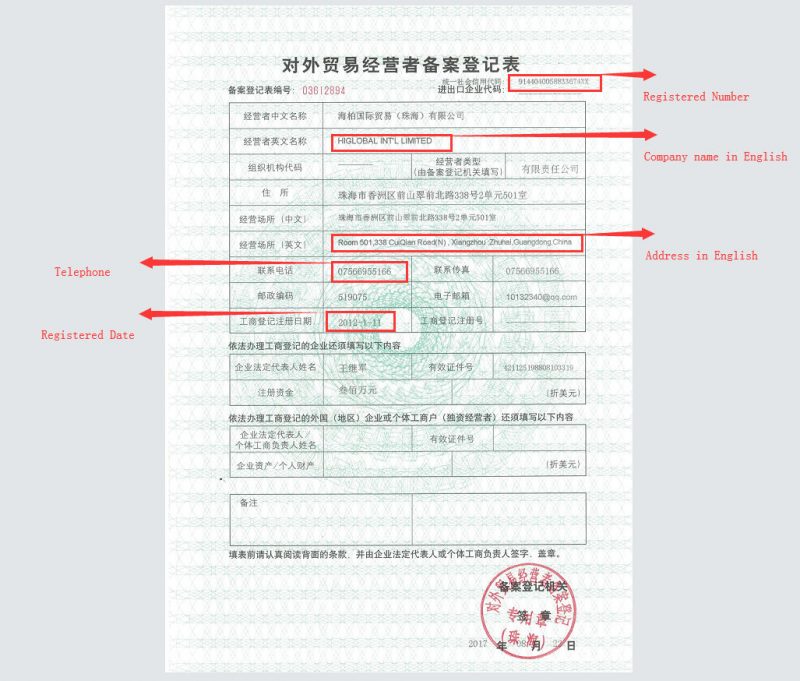

2.Foreign Trade License

The Foreign Trade License was the basic & necessary document for international trade which is issued by the Ministry of Commerce. It is the permit that use for international trade operation amd the company name and address was translate to legal English form . this is the basic document They will be used to sign all documents and bank account information in international trade.

Foreign Trade License

The registration number on the foreign trade license document must be the same as the business license.

You can check if the company you are dealing with is legal and true by comparing the foreign trade license documents with the company information and account information on the sales contract.

3.Customs Registration

With the first two documents, Chinese companies was able to operate foreign trade legally. The Customs registration certificate is issued by the Chinese Customs and is used for custom declaration when exporting goods. customs declaration is divided into self-declaration and agency declaration. Self-declaration refers to the company has the professional declarant to handle the custom declaration . agency declaration means that the company needs to entrust a third-party company to declare to the customs. Generally speaking, small-scale trading companies usually entrust third-party agencies to declare customs, while large factories are self-declared.

Normally the Custom Export Declaration Form and Bill of Lading will shown the real exporter information , you can check if the exporter name was the same as the sales contract .

4.Inspection and Quarantine Registration

The inspection and quarantine registration certificate is similar to the customs registration certificate and is issued by the China Inspection and Quarantine Bureau. It is mainly used for the declaration of origin certificate of general commodities or the inspection and quarantine declaration when exporting food and biological products. Chinese companies can declare themselves or entrust an agent to declare.

You should be aware that large factory suppliers generally do not entrust third parties to handle customs, inspection and quarantine declarations.

5.USD account

The supplier’s US dollar account must be displayed on the PI or on the sales contract. Account information includes: beneficiary, account number, address, bank name, bank address, Swift code.

From the beneficiary we can judge whether the account is a company account or a private account. To do business with a company, of course it should be a company account. Do you still remember the foreign trade licensing documents in the Foreign Trade License? The legal bank account beneficiary should be strictly consistent with the company’s English name on the foreign trade license document.

From the address and bank address, we can determine whether the company account is a legitimate bank account in mainland China. The address and bank address information must include China/CN or CHN in mainland China, not HK/HONGKONG. If the account is not a mainland China bank account, the rights of the payer are not protected by Chinese law.

In summary, when you are ready to do business with a Chinese supplier, remember to ask the supplier to send you the above documents. If all the documents was proved, at least it indicates that the company is a mainland Chinese company with legally registers foreign trade licenses, and your trade is protected by Chinese laws.