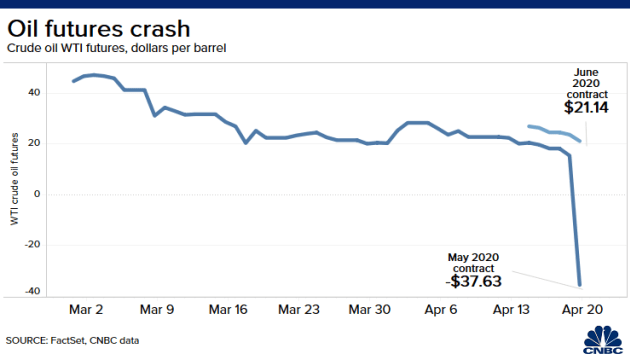

The oil plunged 300%. Why did US oil prices go negative overnight?

US oil prices plunge into negative territory at $37.63 a barrel on Mar 20th. down more than 300 percent. It was the first time oil had Plunge into negative territory since they began trading on the Comex in 1983. A negative oil price means that the cost of transporting oil to a refinery or storage has exceeded the value of the oil itself.

Some analysts believe that the collapse of oil prices caused by multiple reasons. There are three main factors: transport difficulties in the epidemic, the overplus global stockpile, and worldwide supply-demand imbalance.

Transport difficulties in the epidemic

The transportation and infrastructure are affected by COVID-19, while the oil industry relied heavily on them. The oil used in airplanes, cars, ships, and railways accounts for nearly 60% of global oil consumption. In the United States, the oil consumption in transportation accounts for 70%. The epidemic in the United States is now serious, and oil has been affected, with gasoline accounting for half of consumption.

The overplus global stockpile

Oil may face the dilemma of nowhere to store. As oil production is relatively unaffected, oil reserve facilities are increasingly saturated.There is no accurate estimate of how much oil can be stored globally. Analysts from Platts estimate that it is 1.4 billion barrels. By the end of April, 90% of the storage space may be occupied. The landless storage of the extracted oil may be a big problem.

The worldwide supply-demand imbalance

Oil is facing a situation where production is growing while demand is shrinking. According to the international energy agency, global oil demand fell 29 million barrels a day in April, which is the lowest quantity since 1995. The demand is still expected to fall sharply in May and June.

The OPEC&NON-OPEC has reach an agreement in reducing the oil production. However, the slow implementation and the risks have continued to put the weigh on the market.

So how long will the panic of falling oil prices last? Will oil prices stay plunging?

Some analysts believe that the short-term plunging is inevitable. From now to June, there is an eight-week danger period, during which any prediction is unrealistic. However, the situation is not so negative. The oil demand can be improved after the COVID-19 is controlled, the macroeconomic environment improved, and production and transportation resumed. All of these could be better and better in the future.