RMB settlement sweeping global cross-border trade. Is it replacing the US dollar?

Nowadays, economic and trade worldwide are closely related. With a globally integrated economic system, the common currency is indispensable. The US dollar has always been the currency in circulation in cross-border trade.

The People’s Bank of China recently released news about the RMB Internationalization Report 2020. By the end of 2019, the RMB reserves reached US$217.67 billion, accounting for 1.95% of the total foreign exchange reserves of the designated currencies and ranking fifth, surpassing the Canadian dollar. This is the highest level since the International Monetary Fund began to announce RMB reserve assets in 2016.

At present, more than 70 central banks or monetary authorities around the world have taken the RMB into foreign exchange reserves, and the cross-border use of RMB has also grown rapidly. Since 2019, companies have been more active in participating in cross-border RMB business. 84.6% of companies have chosen RMB as the main currency for cross-border settlement. About 82% of surveyed overseas industrial and commercial enterprises said that when the liquidity of international currencies such as the U.S. dollar and the euro are nervous, they will consider using RMB as a financing currency.

It is reported that as the U.S. banking system frequently restrict settlement transactions though the U.S. dollar in oil-producing countries such as Iran. Many countries intentionally stay away from the U.S. dollar. For example, the Central Bank of Iran has already started the layout ahead of schedule and officially listed the RMB as the three major exchange currencies, replacing the original US dollar. Judging from various signs, relevant Iranian institutions may also bypass the sanctions loopholes of the Bank of America through crypto digital currencies.

Iran also proposes to create a cryptocurrency anchored by resources such as oil and gold as one of the ways to counter the dominance of the US dollar. Venezuela announced that it would stop using U.S. dollars for settlement and turn to RMB, euros, etc. for foreign exchange transactions. Nearly one-third of the total reserves held by the Bank of Russia are assets denominated in RMB.

The US financial website Zerohedge reported that the “de-dollarization” of China and Russia reached a breakthrough moment. A considerable part of the Sino-Russian trade gave up the US dollar for bilateral transactions. They believe that the dollar continues to lose its ground.

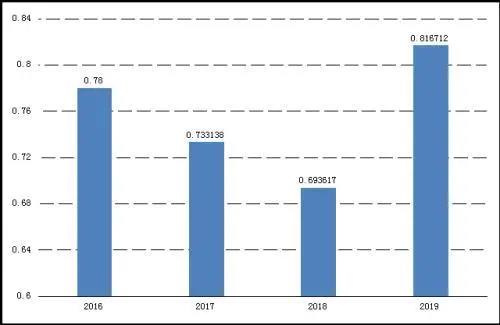

When the liquidity of international currencies such as the U.S. dollar and the euro is relatively tight, the proportion of overseas business enterprises surveyed that use RMB as a financing currency:

At the same time, the trading volume of RMB-denominated crude oil futures has been strong since its listing for more than two years, and the pricing function of RMB appeared in the Asian market. Chinese customers even began to settle crude oil transactions through RMB with foreign countries. Due to the low US interest rates and the policy of US dollar sanctions, it leads to many problems for oil-producing countries. The world needs a new independent cross-border settlement currency. The situation becomes more clear under the background of the Fed’s monetary policy of bankruptcy measures.

As China’s total economy accounts for a further increase in the total, RMB assets become more favored. The RMB exchange rate is expected to remain stable in the second half of the year. And RMB assets will become a “haven” for global assets. Does it also mean that China will have more advantages in global cross-border trade in the future?