Xiaomi launched smart electric vehicle-Explore the innovation system in Chinese energy

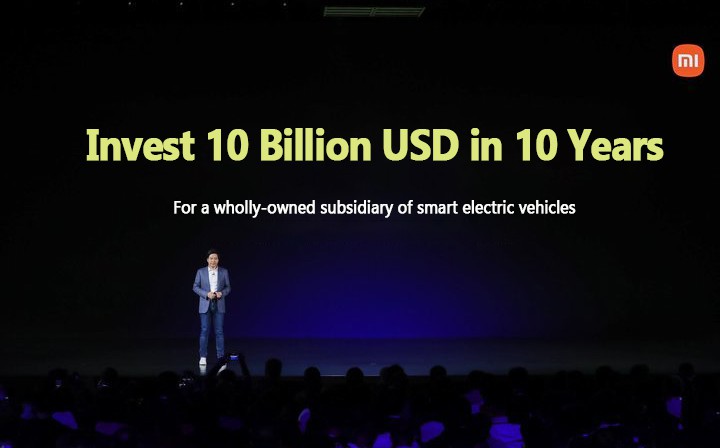

Last night, Xiaomi founder Lei Jun announced at the press conference that Xiaomi will officially enter the smart electric vehicle industry. The Xiaomi smart electric vehicle project will be formally approved in April, and a wholly-owned subsidiary will be established to be responsible for the electric vehicle business. The initial investment is 10 billion yuan, and the subsequent investment will be 10 billion US dollars within 10 years, and all the funds will be provided by Xiaomi, do not accept any external funds, led by Lei Jun himself.

On January 7, 2019, Tesla’s Shanghai Super Factory held a groundbreaking ceremony. The new factory completed the preliminary construction in the summer of 2019. Small-scale production of Model 3 began at the end of the same year, and mass production has begun in 2020. Musk’s Tesla witnessed the “China Speed” with the world.

Why is an electric car company and a smart product company aiming at the Chinese electric car market at the same time?

The fate of a country is often closely related to the “innovative revolution in the energy system”. For example, the rise of the United States in the second half of the 19th century was inseparable from its most contemporary “crude oil system”:

On the production side, Rockefeller founded Standard Oil Company, which improved the efficiency of refining and chemical industry through improved equipment and efficient smelting technology, and then controlled 95% of the US market, and through price wars, hiring rogue literati, and bribing gangs, etc. Controlled 85% of the global market at one time;

On the transportation side, Rockefeller abandoned the widely popular railway transportation at that time and pioneered the establishment of a huge oil pipeline, which greatly reduced oil costs;

On the consumer side, Henry Ford pioneered an assembly-line production method, produced a cheap Model T car, and digested Rockefeller’s oil very thoroughly.

“High-efficiency refining technology-new oil pipeline-innovative automobile production line” finally formed a “production-transmission-utilization” cycle system, which successfully replaced the “coal system” dominated by the United Kingdom and greatly accelerated the development of American industry. In 1929, the United States owned 78% of the world’s automobiles, gasoline and fuel oil accounted for 85% of total oil consumption, and industrial civilization was far ahead.

The “production-transmission-utilization” cycle system has also become the cornerstone of US oil hegemony after World War II.

In sharp contrast, although it is not an oil-poor country, China, as the world’s factory, imports more than US$200 billion in oil every year. If you count the oil pipeline contracts signed with Russia and Iran, and in order to cross the Strait of Malacca. The ports built by Pakistan and Myanmar, and China’s investment in energy security are astronomical.

And to truly break this situation, what China needs is an innovative revolution in the energy field. This is the hottest track today: the “silicon energy” revolution, which is composed of Photovoltaic-Ultra High Voltage-New energy vehicles, corresponding to a new “Production-Transmission-Utilization” cycle system.

The “PV-UHV-New Energy” cycle system has successively ushered in breakthroughs and developments in 2020. China’s energy triangle is gradually being completed, and it has also given decision-makers the confidence to achieve “carbon neutrality” in 2060. Under the cloak of political correctness of “clean energy”, the essence of “carbon neutral” is an energy revolution in which silicon energy replaces carbon energy.

For China, this is an arms race more important than semiconductors.

China’s “Production-Transmission-Utilization” energy triangle is backed by the three huge industries of “Photovoltaics-UHV-Electric Vehicles”. These three industries have very obvious common points: the racetracks are all super-large, and the policies are all. It was the long bet, the intensity was chasing, and in the end, they achieved a certain degree of success-despite the controversy.

New energy power generation field: The global energy market exceeds US$5 trillion. China is betting on multiple new energy sources such as photovoltaics and wind power at the same time. Once technological breakthroughs occur, Chinese companies will rely on huge production capacity to rapidly expand production and occupy 70% capacity of the global photovoltaic industry.

Energy transmission field: The power equipment market exceeds 2 trillion US dollars. China also placed bets on UHV power grids and coal transportation lines. When China’s UHV technology was nationalized, China immediately set off a wave of UHV investment, and even exported its production capacity to Brazil, Kazakhstan and other places, becoming a global UHV construction, the “general contractor”.

New energy vehicle field: The global automotive market exceeds US$3 trillion. At the same time, China placed bets on pure electric vehicles, gasoline-electric hybrids, and even hydrogen energy. When China mastered battery technology, its production capacity soared to more than 70% of the world’s total, and sales of new energy vehicles exceeded 50% of the world.

It is precisely because of this full bet on the big track that it waited until the final bloom. But this kind of rare saturation betting ability on the track can hardly find a second example in the world.